Have you discovered unforeseen roof damage due to a recent hailstorm? Are you unsure how to proceed with the Hail Damage Insurance Claim Process? This article details the steps of how to make a hail damage insurance claim so that you can identify roof damage as you file a claim. Instructions on forms and repairs carry out in a timely manner and save time and money as well. The steps must follow along are placed easily now, right down to exactly what you have to do to make a claim to make sure you keep from the coverage on your property and to restore it in no time.

Key Takeaways on the Hail Damage Insurance Claim Process

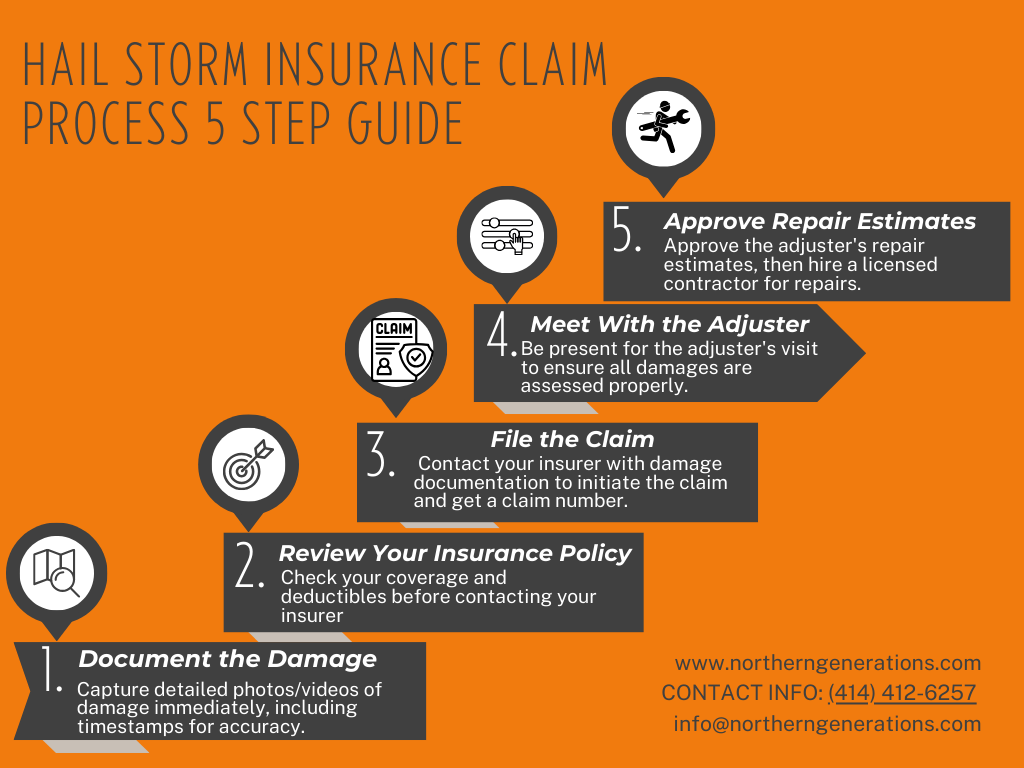

-Document the Damage: Take clear photographs of all damage and keep detailed notes. This will be used to support your claim for insurance purposes.

–Review Your Insurance Policy: Know what your policy also covers. Take particular note of the deductible, as this will save you work when making a claim.

–Contact Your Insurance Company: Report the damage as soon as possible. It is vital for starting the ball rolling on recovery and repair.

–Finalization of the Claim: After the insurance adjuster has done its assessment and repair estimates have been received, you review and finalize your claim to make certain all damages were considered and repairs can begin.

Extra Tip: Hire a Professional Contractor

If you are interested in saving time and keeping the stress of navigating through the Hail Damage Insurance Claim Process you should look into hiring a professional contractor. A qualified professional will help immensely in documenting all the damage that has been done, estimating repairs that must be done in an accurate way, even going so far as to communicate with the insurance adjuster on your behalf. It makes the whole process more streamlined for the convenience of the customer, and there are lighter burdens to shoulder. To find out how the experts can assist you in the best possible way, visit our homepage.

Understanding Hail Damage and Insurance Coverage

Northern Generations Roofing & Remodeling observes that hail storms can lead to significant collateral damage, affecting both roofs and nearby structures. Accidents caused by heavy hail can prompt timely hail damage repairs that prevent further expense. An adjuster often assesses the damage to determine the coverage available on insurance policies.

Property owners noticing signs of impacts from severe weather should report accidents that may have caused unseen collateral damage. Hail damage repairs are vital to restoring safety and function, and an adjuster plays a key role in verifying the necessary fixes. The process works to ensure proper compensation and curb excessive expense for homeowners.

Insurance policies often cover damage from such incidents, reducing the burden of unexpected expense. A prompt consultation with an adjuster helps clarify if hail damage repairs and collateral damage are included under the policy. Homeowners may then proceed confidently through the streamlined claim process after recording accidents and assessing structural impacts.

Steps to File a Hail Damage Insurance Claim

Homeowners using the hail damage insurance claim process must document the damage on roofs, garages, and surrounding areas. File a claim, collect repair estimates, meet with the insurance adjuster, receive a payout, and then hire a contractor. These steps help address damages while managing risk and preventing theft effectively.

Document the Damage

Northern Generations Construction recommends homeowners capture detailed photos and notes of every impacted area, covering roofs, air conditioning units, and nearby structures to support claims related to flood insurance and liability insurance, and to prepare a solid invoice for repair work that strengthens negotiation during the claims process:

- Photograph all visible hail damage on roofs and siding

- Record the condition of air conditioning systems and other vital components

- Keep copies of the invoice for any immediate repair services

- Compile notes detailing the extent of damage for insurance adjusters

File a Claim

Northern Generations Construction explains that filing a claim for hail damage requires homeowners to document every detail clearly and remain organized, ensuring that roof insurance and insurance covers align with the insurance cover provided by the policy. This approach helps secure a hail damage claim that addresses both immediate repair needs and any potential structural issues, supporting a smoother process for homeowners.

Collect Repair Estimates

Northern Generations Construction advises homeowners to gather repair estimates that detail the impact of storm damage, ensuring any issues with a hail damage roof or accidental fire damage are clearly noted. Experienced professionals highlight that precise estimates help determine if the policy covers repairs before damage escalates into a total loss, providing peace of mind and a smoother claim process.

Meet With Your Insurance Adjuster

When meeting with an insurance adjuster, homeowners are advised to organize all documentation and ask key questions about their hail damage roof insurance claim process and homeowners insurance policies; effective communication with insurance companies ensures accurate handling of hail damage claims:

- Compile detailed photos and notes of the damage

- Gather repair estimates for review

- Clarify coverage details and compensation limits

- Discuss steps and timelines with the adjuster

Receive a Payout

Northern Generations Construction explains that after proper documentation, the payout represents the actual cash value of roof damage insurance claims, serving as a sound investment for property repairs. Homeowners often find relief knowing that the process accounts for damages not only to their roof but also integrates factors like the impact on a vehicle, ensuring clear understanding of the compensation offered.

Hire a Contractor

Northern Generations Construction advises the homeowner to secure a reliable roofing contractor who specializes in roof hail damage repairs after initiating their hail damage insurance claim. They recommend providing your email address to facilitate prompt communication and scheduling of detailed inspections and estimates. Trusted experts work with homeowners to ensure repairs meet quality standards while preventing further damage to the property.

Identifying and Repairing Hail Damage on Your Roof

Northern Generations Construction clarifies that thorough visual inspections help spot signs on roofs, like cracked asphalt shingle and damaged tree areas near a condominium. They highlight clear indicators of hail damage and review repair options, from DIY fixes to professional work. This insight benefits personal finance and pet insurance planning during storm recovery.

Visual Inspection Approaches

Homeowners must carefully inspect their roofs after a storm, paying close attention to signs of damage on metal surfaces and other vulnerable areas, as careful visual inspections are key for a successful roof insurance claim; this approach helps ensure that any irregularities noted can support property insurance filings and expedite roof insurance claims when working with a reputable roofing company:

| Inspection Step | Key Details |

|---|---|

| Visual Evaluation | Thoroughly examine shingles and metal areas for dents or cracks. |

| Damage Recording | Capture clear images and notes of impacted spots for property insurance records. |

| Consultation | Engage a reputable roofing company to verify findings and guide the roof insurance claim process. |

Indicators of Hail Damage

Roofing professionals note that hail often marks surfaces through dents, cracks, and broken flashing, clearly signaling when a property needs careful assessment. Homeowners in Dallas and Georgia frequently observe these signs and may consult a lawyer to ensure that the repair process aligns with their insurance coverage and quality standards.

Types of Hail Damage Repairs

Repair professionals often replace damaged tile and concrete components to restore the integrity of a storm damage roof, ensuring all roofing efforts adhere to the insurance policy guidelines. This hands-on approach directly addresses homeowners’ repair needs while providing proven, quality results that stand the test of time.

DIY vs. Professional Repairs

Homeowners deciding between DIY repair and hiring experts must weigh the risks and rewards, especially when dealing with an accident from extreme weather. Professionals offer specialized services such as paintless dent repair on a metal roof, ensuring work complies with law requirements and delivers lasting results that DIY methods may struggle to achieve.

Navigating the Insurance Claim Process in Wisconsin

This guide covers hail damage claims. It suggests contacting a local roofer, speaking with the insurance company, and documenting roof damage. The process reviews policy details and contract terms before meeting an adjuster to settle a fair agreement. A mobile app can simplify checking property damage insurance after wind damage appears.

Contact a Local Roofer

In Wisconsin, homeowners benefit from contacting a local roofer who performs a detailed inspection to assess all aspects of hail damage, including any hidden flood effects. The professional ensures that repair estimates cover factors like the deductible and any required fee adjustments, while also coordinating with vehicle insurance when related damage to nearby property is evident.

Contact Your Insurance Company

Contacting the insurance company is a key step for ensuring that roof repairs are handled efficiently, as the process verifies that the comprehensive coverage includes the warranty for both visible damage and regular wear and tear on the property; this approach benefits the business and homeowners by offering clear guidance throughout the claim submission and review process:

- Gather all relevant repair estimates and documentation

- Confirm that the policy covers both immediate repairs and ongoing wear and tear

- Discuss policy details to verify the comprehensive warranty and claim timeline

Document the Damage

Northern Generations Construction stresses the importance of recording every detail of hail damage for a smooth insurance claim process, as accurate information supports home insurance cases and ensures that a roofer’s insights guide repair needs effectively:

- Capture clear photographs of the affected roof and nearby areas

- Note specifics such as dents, cracks, and other visible damage

- Gather repair estimates from trusted professionals

- Secure a roofer’s assessment to confirm the extent of repairs required

Review Your Policy

Homeowners should review their policy to check if insurance claims cover damages to roofs, wood structures, or even a garage door, which in turn can affect their mortgage arrangements. This review clarifies what the insurance company covers and prepares them to handle repairs efficiently. Practical insights from experienced contractors suggest that a thorough read of the policy streamlines the claim process and reduces the risk of surprises later on.

Meet With an Adjuster

In Wisconsin, meeting with an adjuster gives homeowners a clear view of how repair cost, depreciation assessments, and even aspects of life insurance can affect the claim process, allowing them to file a claim with confidence and secure the correct payment. They compile necessary documents and address questions to avoid unexpected cost issues:

- Acquire detailed photographs and notes of the damage

- Collect repair estimates showing cost breakdowns

- Review depreciation details related to the repairs

- Discuss any life insurance implications impacting the claim

- Confirm the procedure to file a claim and receive payment

Negotiate Your Settlement

Northern Generations Construction advises that homeowners discuss every detail of their damage insurance case during settlement talks, ensuring the policy offers comprehensive coverage that includes water damage and future maintenance needs. Experts in home repair often bring clear cost estimates to these discussions, helping to secure funds that support both immediate fixes and long-term care. This approach gives property owners a fair settlement that covers all aspects of their claim effectively.

FAQ on the Hail Damage Roof insurance Claim Process

This section addresses key concerns. It outlines the statute of limitations for filing a hail damage insurance claim and explains if homeowners insurance cover applies to all roof damage.

What Is the Time Limit for Filing a Hail Damage Insurance Claim?

In Wisconsin the time limit for filing a hail damage insurance claim can be backtracked all the way to 2 years of the storm but, time limits for filing hail damage insurance claims vary by policy and region, so any damage should be immediately reported and inspected. Homeowners should read their policies as soon as possible and file within the stated limit to get all repair work done without needless hassle. By filing quickly, the claim process has a better chance of being protected and funded properly to fix roofs and related services.

Does Homeowners Insurance Cover All Types of Hail Damage?

In many cases, substantial hail damage is covered by homeowners insurance. Such substantial damage can be roof damage that can easily be seen and verified. Minor hail incidents causing normal wear and tear to the shingles may be excluded. It is important for the homeowner to review their policy, and contact the insurance company directly, to make sure hail damage that includes a “major repair” is covered under their policy and to assist with the easy completion of an insurance claim.

Does Insurance Cover Roof Damage from Hail?

Yes, in just about all cases, damage from hail is covered under your homeowners insurance. That is, it generally covers this type of damage since hail is viewed as one of those uncontrollable acts of Nature. However, more details depend on your particular policy, that is, the terms of it: age of the roof, your state of residence, etc. In some cases, if your roof is older, a policy may cover it for only depreciated value, while in other situations, a policy might cover an entire replacement when needed.

Understanding Hail Damage and Claims Process

The claim process begins with documenting the damage, followed by contacting your insurance provider to file a claim. An adjuster will assess the damage, and if approved, you will receive funds for repairs based on your policy details.

How long after hail damage can you file a claim?

Most insurance policies require claims to be filed within one year of the hail event, but it’s best to file as soon as possible. in Wisconsin local roofing companies like Northern Generation can backtrack up to 2 years on hail damage and storm reports.

Is hail damage to the roof covered by insurance?

Yes, most homeowner’s insurance policies cover hail damage as it is considered an act of nature. Check your specific policy for coverage limits and deductible information.

Is it worth filing a claim for hail damage?

It depends on the extent of the damage and your deductible. If the repair cost significantly exceeds your deductible, it’s generally worth filing a claim